Why ROI is the North Star in Real Estate When I evaluate an investment property in the United States—whether it’s a buy-and-hold rental, a short-term rental, or a fix-and-flip—I start with ROI (return on investment). ROI helps me compare apples to apples across markets and strategies, and it keeps me honest about both income and […]

Short answer Yes. You can identify a property yourself and send it to Luvanex for end‑to‑end guidance through the U.S. home‑buying process. For best results, focus on properties that are not recently “lip‑sticked” or heavily refurbished purely for resale, so that third‑party appraisals align with the contract price. Why remote homebuying makes sense in the […]

Why U.S. Real Estate Attracts Global Investors I’ve spent years watching how the U.S. housing market rewards smart, patient investors. Strong legal protections for property rights, deep rental demand in major metros and fast‑growing Sun Belt cities, and a stable currency make the United States a uniquely resilient place to build wealth. That’s why international […]

Buying property across borders is exciting—and tricky. Funding is often the hardest part. Lenders, documentation, currency rules, and residency status all shape what you can borrow and on what terms. The good news? If you’re purchasing in the United States, viable financing paths exist for non‑U.S. citizens and non‑residents. I’ll walk you through how they […]

As a smart investor you will want to buy a home as soon as you come across the right one. But it’s not always that simple. There are many financial issues that will determine whether you’ll be able to purchase the house, as well as the terms of your mortgage. Understanding the requirements to buy […]

Why Property Investment Still Makes Sense I’ll be honest: property investing isn’t magic—but it can be methodical, repeatable, and kinder to your nerves than most headline-chasing assets. Well-chosen real estate has powered wealth for generations because it blends three engines of return: If your long‑term goal is financial independence—covering your lifestyle with passive income while […]

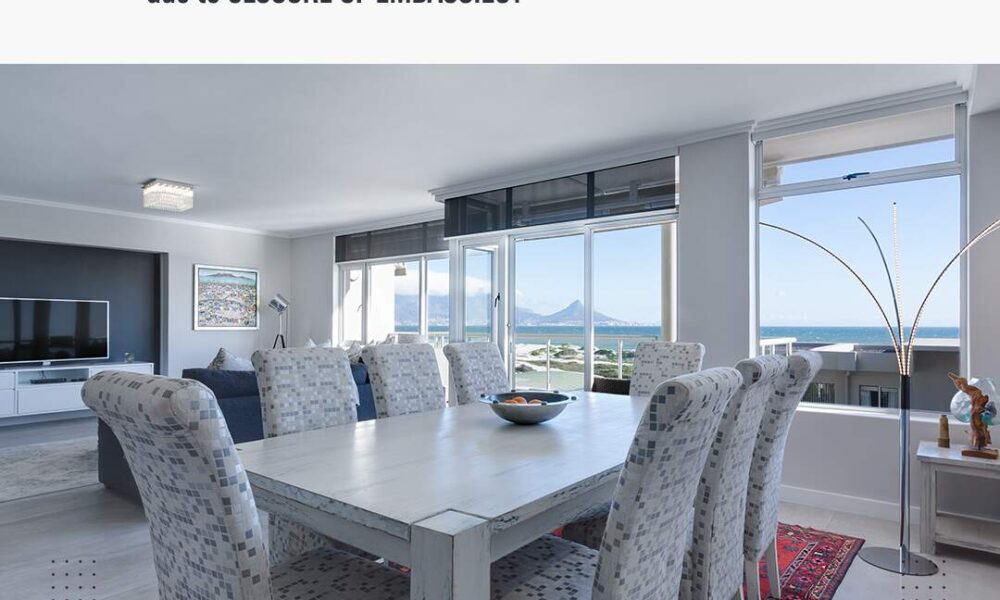

Why embassy closures affect cross‑border closings Real life doesn’t pause for a closing. When U.S. embassies or consulates pause in‑person services—whether due to public holidays, security advisories, public health emergencies, or staffing constraints—international buyers and sellers can’t easily notarize, authenticate, or apostille documents abroad. That roadblock can delay a U.S. real estate closing unless you […]

If you earned your permanent residence through the EB‑5 Immigrant Investor Program and you’re ready to take the final step to U.S. citizenship, this guide breaks down the process in plain English. I’ll cover eligibility, timelines, how to file Form N‑400 online or by mail, common pitfalls, interview tips, and benefits of naturalization that matter […]

Buying a home in the United States often raises a familiar question: Do investors or homebuyers have to pay PMI? The short answer: you might, and it depends on your loan type, your down payment, and how the lender evaluates risk. Let me walk you through the essentials in plain English so you can make […]

Paying off a mortgage ahead of schedule can save thousands in interest—but in the U.S., some loans may charge a prepayment penalty if you refinance, sell, or make very large extra payments within a defined window. I’ll break down how these charges work, where you’re most likely to see them, typical costs, and practical strategies […]

Ever since the dawn of the COVID-19 pandemic, the U.S. real estate market has been on a tear. In the twelve months between August 2020 and August 2021, American home prices rose by a national average of 19.8%—the highest annual increase ever recorded. But this national uptick in housing prices has hardly affected every place […]

Buying or selling a home comes with a simple, transparent question: how much does your real estate brokerage earn? Here’s a clear breakdown of how Luvanex Realty structures commissions, what that means for you, and why it matters. Our Standard Commission Who Pays the Commission? What Our Commission Covers Your 3% isn’t just a fee—it […]